May 15, 2018 | Events, Informative, RIsk Management News

Recently, I had the chance to spend some time at Walt Disney World in Orlando, Florida, when I attended the NAMIC conference in February. One session included a presentation by Barry Dillard, director of claims for Walt Disney World, where he shared the company’s approach to handling a wide variety of claims.

I sat down with their vice president of risk management to learn about some of the strategies they employ, and I had the opportunity to tour Walt Disney World itself to peek behind the curtain and see how this massive theme park creates the magic for its guests and cast members, while keeping everyone safe.

Believe it or not, the Walt Disney World Resort covers 40 square miles and is twice the size of Manhattan. Within its confines, this world-class attraction employs 75,000 cast members, each of whom play a critical role in spreading the Disney magic. Their emphasis on safety is both taught and caught, which is especially important when serving the millions of guests who visit the Disney attractions around the world.

The Walt Disney Company is extremely proactive in their risk management strategies — it truly is everyone’s responsibility — not just the realm of those at the corporate level. As is often the case in life, the simplest things can make the biggest difference. Merely walking the parks, hotels, shops and restaurants can yield valuable information, allowing cast members to identify small issues before they become larger ones. Even in one of the most magical places on earth – reality tends to intrude.

Unexpected risks arise every day and training plays a key role in mitigating them. Hackers are constantly devising new ways to access company information or hold it for ransom. The use of ransomware is expected to increase 350% this year, so being vigilant and backing up data has never been more important.

The number of shooting incidents in businesses and other settings is increasing at an alarming rate. Knowing what to look for and how to respond in these situations can literally be the difference between life and death.

For better or worse, new risks are changing our behavior — how observant we are in open spaces of our surroundings, what we post on social media, where and how we protect our personal information, what we open online and how we train our staffs. It really is the smallest things that can make the biggest difference in keeping people safe.

Source: PropertyCasualty360

Author: Patricia L. Harman

May 2, 2018 | Blog-All, Informative

Although weather is often unpredictable and always uncontrollable, businesses can go a long way toward mitigating damage with careful preparation. According to a 2018 report by the U.S. Chamber of Commerce and MetLife, however, more than one-third of small businesses have no emergency plans in place for natural disasters or severe weather, and while larger businesses often have business continuity and disaster recovery plans, many of them do not account specifically for weather-related events.

To ensure your organization is prepared, planning for a natural disaster should include the following steps:

- Create internal emergency-response teams and identify the roles of everyone on the team. Specifically highlighting what their roles are during weather-related emergencies will ensure each team member knows what to focus on as the event unfolds. Team members with the right skills and knowledge can then address their areas of expertise, knowing that other issues are covered by people with the appropriate skillset.

- Train key employees on technology to mobilize crisis-response teams, alert staff, and suppliers, and account for personnel safety. This preparation enables team members to move quickly when making decisions and share important information with all audiences, no matter how narrow or broad, rather than trying to learn and understand new tools in the midst of managing an event.

- Implement human resources policies for employee notification, remote work and accessibility for people with disabilities for both large and small events. In most cases, basic policies and procedures provide all of the necessary information to keep individuals safe and secure; however, some events are more complex and require giving employees specific instructions in advance.

- Create and distribute shelter-in-place, evacuation and medical emergency procedures informing employees of exactly how to respond or where to go. In many types of severe weather events, there is very little time to make decisions, so having predefined meet-up locations and procedures enables people to respond quickly and confidently.

- Keep a current list of contact information for all employees, response-team personnel, utility companies, Federal Emergency Management Agency (FEMA) officials, the local Red Cross chapter and local first-responder organizations, ensuring the right people are acting on the information that they have the skills and authority to manage.

- Build and maintain off-site support for business continuity so information channels remain open and functioning at all times, such as through a software-as-a-service (SaaS) solution that is not tied to specific hardware or a physical location that could be impacted.

Ensuring Effective Communication

Once these initial steps are complete, organizations should focus on preparing for effective communications before, during and after severe weather events to protect their operational, financial and strategic assets.

Evaluate emergency mass notification systems. When it comes to mitigating the effects of weather events on businesses, employees, customers and suppliers, speed is imperative. This should include the use of an emergency mass notification system (EMNS) to warn and update employees and suppliers about business closings and emergency measures. Some systems can automatically notify employees in advance of severe weather events as soon as the National Weather Service issues a bulletin.

Ensure EMNS can reach users through multiple channels. Effective mass notification systems use multiple methods of communication, such as phone calls, instant messages, desktop alerts, social media posts, mobile apps, SMS and emails. Using different methods of notification, or “multimodal alerting,” helps to ensure that messages can be delivered quickly without human intervention and mitigate single points of failure. Because technologies and methods of communication evolve over time, make sure to choose a vendor that stays up-to-date on how to use all means of communication.

Ensure two-way communications. Your organization’s emergency communication system should be capable of two-way communications to help ensure the safety of personnel and continuity of operations. Decision-makers within organizations need a system that not only can deliver real-time, mission-critical notifications in any message format required, but provide a way for message recipients to respond as well. With two-way notification capability, IT and security administrators can communicate with employees to determine if they are safe and report the results so the emergency response team can keep a running tally of who still needs to be contacted. This is critical during severe weather events when employees scattered across multiple locations may be impacted and must be accounted for.

Ensure geo-targeting based on severe weather track. The ability to target groups of employees, customers or suppliers in specific geographic areas is important, especially in weather-related emergencies where the severity of warnings or expected impact may differ depending on the area. The most effective systems can geographically target only those in the path of the weather event, and can automatically plot contact addresses on a map, allowing administrators to choose specific areas they want included or excluded from an alert.

Conduct periodic testing. Once the policies, procedures and communications technologies are set, they should be tested periodically with different drills for each type of weather event. Then, after the next weather event has taken place, set aside time to assess how effective the response was, and adapt and update your plan accordingly.

Source: RMMAGAZINE

Author: Aaron Charlesworth

May 31, 2017 | Blog-All, Informative

Last year, the rise of the Internet of Things (IoT) was covered by mainstream and tech trade media almost as closely as the U.S. presidential election.

As consumers saw the potential for their myriad devices to become smarter and more tightly connected, businesses began investing in developing IoT capabilities. For example, refrigerators in connected homes are fitted with internal cameras so that homeowners can see how much milk is left, even while standing in the supermarket. For parents of teen drivers, the Hum “connected vehicle” device from Verizon Wireless provides text or email alerts if a vehicle exceeds a maximum speed, or if it moves outside a preset boundary area. Such devices aim to make consumers’ lives easier and more efficient — and, in the case of the Hum, safer — while saving time and money.

Just as the universe of IoT devices, services, wearables, handhelds, and cloud-based software solutions is transforming the consumer experience, it’s also beginning to transform the insurance marketplace. Old-line carriers and startup web-based insurers alike are pursuing new technology offerings.

So far, startup insurers have focused mostly on the consumer and small commercial marketplace, disrupting the agent/broker model to go direct to consumers. One of these is Lemonade, an insurer focusing initially on the homeowners and renters marketplace in New York City that has the backing of Google, Sequoia, and XL Innovate. Lemonade has raised more than $34 million in initial funding, bringing the company’s total funding to date to more than $60 million. In 2011, another online startup, Esurance, was acquired by Allstate Insurance for nearly $1 billion, although it has yet to earn a profit.

Many of these startups, and some more mainstream insurers, are including some type of hook with IoT devices, driving reductions in premium costs based upon use. The Snapshot plug-in from Progressive Insurance monitors a driver’s actions in order to reward good drivers with lower premiums. And Nest has partnered with a number of carriers to give a discount to policyholders who use its safety and security devices in their home, similar to discounts for having hardwired smoke/heat detectors and central station alarming.

Attacking the biggest costs

As carriers from Berkshire Hathaway to State Farm to Allstate battle it out in the consumer marketplace and the small commercial marketplace, many corporate risk managers for midsize to large enterprises are quietly seeking out IoT services that can attack their biggest risk management expense. They are using IoT technologies to reduce employee and customer accidents and the associated costs.

For the past 50 years, commercial property/casualty insurers have competed primarily on price. Although carriers do try to differentiate themselves as experts in specific industries, their focus on competitive pricing has conditioned corporate risk and finance managers to focus on the fixed costs of their programs, which account for only 20 to 30 percent of their total cost of risk. Through this competitive bidding process, agents/brokers have been able to fully commoditize the fixed-cost components of a company’s total cost of risk.

The fixed cost of an insurance and risk management program will become more and more irrelevant as brokers, insurers, and other service providers bring IoT solutions to rapidly and permanently address the other 70 to 80 percent of a company’s total cost of risk.

Suppose, for example, that a retailer incurs and retains losses of $3 million annually as a result of customer slip/fall claims. Meanwhile, it pays a $300,000 premium to an insurance carrier to access the insurer’s claims-adjusting services and to provide excess coverage in the case of a catastrophic claim. Corporate finance and risk managers have traditionally focused mostly on reducing the fixed costs in a program — the premiums. But even if the retailer in our example can reduce the fixed costs of its program by 20 percent, through carrier competition coordinated by its broker/agent, the program will cost $240,000 in fixed premiums and will have the same $3 million in claims. Ultimately, therefore, the retailer’s total cost of risk will fall by only 1.8 percent.

Significant reductions in the cost of risk

With the advent of IoT, insured clients, brokers, and carriers are beginning to bring a laser focus to the largest piece of the liability pie: claims that result from their own number-one cause of loss — customer slips and falls, in the example above. If a company’s broker can embed a proven IoT loss-reduction solution in a policy, then even if the insurance premium costs more, the insured company may realize significant and permanent reductions in its total cost of risk.

In the example of the retailer, suppose that its insurance premium actually increased 10 percent, to $330,000, but that the new policy included a carrier-deployed IoT strategy that produced a 20 percent reduction in customer accidents, to $2.4 million. Even though the premium was higher, the total cost of risk for this client would be reduced by 16 percent, to $2.73 million with the IoT solution, versus $3.24 million in the traditional broker-led carrier competition. Thus, in this example, paying an additional $90,000 in premium to a carrier with an IoT solution would result in a dramatic and sustainable reduction in total cost of risk.

Insurers are applying a host of different IoT-related technologies to reduce the number of claims their clients face. Sensors are simultaneously growing more complex in their application, far less expensive, and more easily adaptable to everything from machine vibration to the working height of a construction worker. Applications that are just now emerging will enable corporate risk managers to quickly and permanently reduce their total cost of risk by monitoring the activities and/or employee behaviors that lead to their desired outcomes.

Sensors & IOT in retail, food industry

Sensors and IoT tools are also rapidly expanding their footprint in the retail space, particularly in the food industry. Supermarket and restaurant-industry operators are searching for ways to become more efficient in complying with record-keeping and food safety laws driven by the Food and Drug Administration, the United States Department of Agriculture, and local and state health agencies. Software vendors have recently begun to emphasize the chain of custody of food. Sensors placed in trucks, rail cars, and airplanes can create a record that shows whether freight carriers have handled the food in an environmentally safe manner. And sensors placed directly in the shipping containers can measure the temperature of the product throughout its life journey.

Unfortunately, safety monitoring often stops at the back door of the restaurant or supermarket, because operators do not have the required skills to use sensor-based technology indoors. This is where insurance carriers and brokers can provide a value-added service to their clients: As specialists in risk-mitigation strategies, carriers and brokers need to help companies integrate sensor-driven data, in real time, into actionable operational information that corporate management can use to monitor desired behaviors and imperatives. Measuring employee compliance with inspections that are business-critical, required by law — or both — can help an organization achieve an immediate and sustainable reduction in the number and severity of customer and employee accidents.

Simplify regulatory compliance

For the food industry, technology vendors are working to simplify regulatory compliance through platforms that automate alerts for problematic temperature conditions in food-storage areas, and that document compliance with all levels of required inspections. Businesses that monitor employee and third-party practices in real time can enforce and document compliance. This means that restaurants, for example, are less likely to face foodborne-illness claims—claims that are not only costly in terms of lawsuits related to food poisoning, but also highly damaging to the corporate brand. Just ask Chipotle.

Recently, Hartford Steam Boiler, a provider of equipment-breakdown insurance, invested in Augury, a predictive machine diagnostics company. Using vibration and ultrasonic sensors, Augury’s platform “listens” to equipment and uses proprietary analysis and algorithms to determine whether a machine is working properly or has a malfunction. Augury is starting with diagnosing heating, ventilation, and air conditioning (HVAC) systems in commercial buildings. By identifying maintenance needs and areas of vulnerability in insured machinery, the Augury technology has the potential to save billions of dollars for insurers like Hartford Steam Boiler and their clients.

By increasing internal and external compliance rates, lowering risk, and minimizing claims, IoT technologies have the potential to substantially reduce the total cost of risk for companies in the food industry, the retail sector, manufacturing, and beyond.

Next steps

For corporate finance and risk managers, here are some next steps in determining how the IoT might benefit your risk management practices:

- Begin a conversation with your broker regarding the rapidly evolving practice of using IoT solutions to solve specific risk issues. Ask what IoT solutions are available to bring down risk management costs for businesses like yours. Consider requesting a similar briefing from insurers that profess to be experts in your industry.

- For any proposed IoT solution, get true empirical evidence that it works. It’s best if the evidence comes from an independent third party or university-supported study.

- When evaluating your insurance and risk management program, consider seeking service-level agreements that target specific reductions in your number-one cause of losses, based on your successful commitment to — and execution of — an IoT-based loss prevention program.

Consider asking your insurance carrier for a multiyear commitment based on successful implementation of its IoT-based strategy.

Speak with your peers about innovation within your industry and about what they may (or may not) be doing in the deployment of risk mitigation solutions.

- Speak with your industry association to find out what they are seeing in the way of risk mitigation strategies.

Remember to focus on solutions that solve the big problem, such as general or workers’ compensation claims. You may want to pay more for a turnkey solution that is proven to reduce losses.

- As sensor costs fall and the flexibility of data analytics software advances, IoT solutions will become increasingly prevalent in the insurance market. The challenge for everyone involved in an insurance transaction — broker, carrier, and insured client — is how to evaluate the IoT solutions that are part of an insurance offer.

Originally published on Treasury and Risk. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Source: Property Casualty 360

Source: Treasury and Risk

May 2, 2017 | Blog-All, Informative

The threats posed by cyber attacks and identity theft continue to grow as cyber criminals always seem to be on offense while consumers and insurers are on defense.

A study recently released by Javelin Strategy and Research found that cyber criminals stole more than $16 billion from over 15 million U.S. consumers last year.

A new risk assessment tool, the Identity Threat Assessment and Prediction (ITAP) model developed by the University of Texas at Austin Center for Identity, provides unique insights based on research into the behaviors and methods of identity threats, and aggregates the information to help risk managers assess dangers and vulnerabilities. The information in the ITAP database is collected from news stories and other sources, and the repository currently holds data from more than 5,000 incidents that occurred between 2000 and 2016. Researchers apply a number of analytical tools to this information in order to compare threats, and identify trends and losses.

As a result of their examination of the information, researchers have identified six key takeaways, as well as other data that help to paint a broader picture of the impact of identity theft on consumers and businesses. Here is a look at some of their findings.

1. People make mistakes

The researchers found that human error is a major driver when it comes to identity theft and that hackers frequently exploit vulnerabilities created by mistakes people make. However, approximately 17 percent of the incidents where personally identifiable information (PII) was compromised were termed “non-malicious” or not instigated by hackers, but by individuals without malicious intent.

2. Impact is usually local

Despite the activities of hackers around the globe, the impact of identity theft where PII was compromised seems to be more localized to specific cities, counties, states and regions. The study found that over 99 percent of the cases were limited to either a local geographic area or a particular type of victim. Only 0.36 percent of the theft incidents actually involved the entire country like the Target or Home Depot breaches.

The states with the greatest number of cases of compromised PII were California, Texas, Florida, New York, Georgia, and Illinois according to the ITAP model.

3. The cost is not always monetary

While there are very real financial costs associated with any type of data breach or loss of PII, a larger number of individuals who become victims suffered from emotional stress than those who had actual monetary losses. The University of Texas at Austin researchers found that the “emotional impact is consistently higher than other types of loss.”

The ITAP model identified four different types of loss and the percentages of loss experienced by victims: Emotional distress (72 percent); financial (57 percent); property (56 percent) and reputation (41 percent).

Annual income of the victims doesn’t really seem to come into play either, although 73 percent of adults had their PII compromised as compared to 8 percent of teenagers and 21 percent of seniors.

4. Insiders pose a serious threat

While unknown hackers or foreign countries perpetrate the majority of attacks (62 percent), the researchers found that one-third (34 percent) of the incidents involving compromised PII originated from company employees or family members of affected individuals.

Perpetrators utilize a number of resources to steal the information including computers, databases, computer networks, malware and stolen credit cards. ITAP also differentiates between the various perpetrators involved in identity crimes. Hackers tend to exploit digital or computer-based vulnerabilities, while fraudsters are usually involved in exploiting the information which has been stolen by the actual thieves.

5. Cybersecurity isn’t always the cause

More than 50 percent of the incidents involving identity theft, fraud or abuse identified by the ITAP did not originate from vulnerabilities that were exploited.

Financial losses were associated with particular attributes as part of the ITAP analysis. These were the top five identified: Magnetic stripe ($28.9 million); ATM pin ($24.2 million); fake identification card information ($15.1 million); financial information ($13.7 million) and age ($11.9 million).

6. Identity crime affects all industries

Hackers are indiscriminate when it comes to choosing victims. The ITAP analysis found that a wide range of public and private sectors are impacted with the top five sectors identified as: consumer/citizen; healthcare and public health; government facilities, education and financial services.

The research effort was support by several organizations that focus on cyber protection: LifeLock, TransUnion, Safran, LexisNexis, HID, Generali Global Assistance, and Applied Fundamentals Consulting.

Source : Property Casualty 360

Photo: Shutterstock

Apr 26, 2017 | Blog-All, Informative

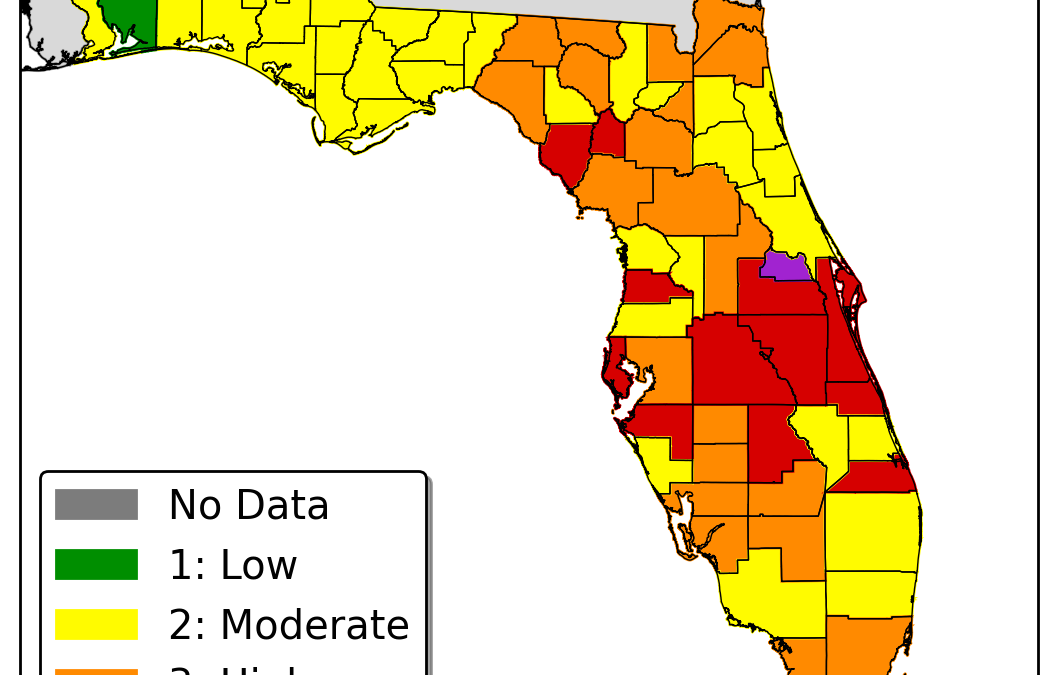

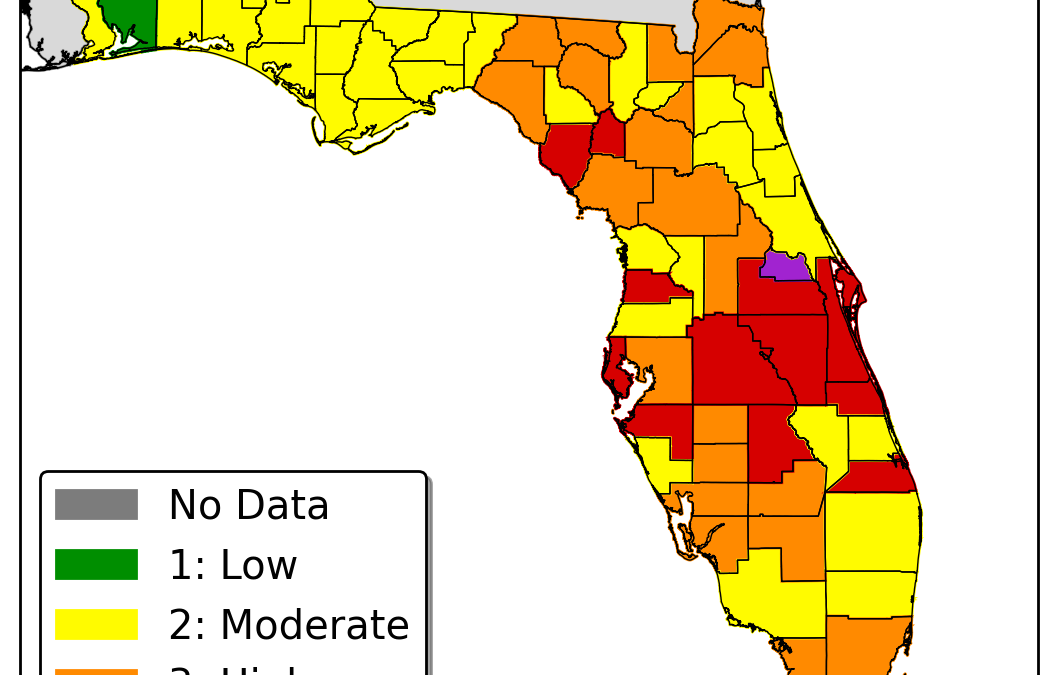

Forecast Fire Indices

The wildfires burning across the state of Florida this month highlight the increasing danger a changing climate poses in the southern United States for this type of catastrophic event.

Wildfire risk is generally perceived to be a western United States problem, and the majority of major insurance losses caused by wildfires to date have occurred in California; but southern U.S. states have been plagued by wildfires in recent years, including the more than 100 wildfires actively raging across Florida this month.

“Traditionally, we see the wildfire exposures in the western half of the United States, but recently the South is experiencing warmer-than-average temperatures and drier-than-average seasons,” said Jim Clifford, director of safety and prevention programs for insurer USAA based in San Antonio, Texas. “Florida has a history back and forth, having a drought occasionally, and the Everglades have extensive forest — and they tend to burn quite easily when there’s a little bit of a drought.”

Climate change is causing increases in temperature across the Southeast, according to the U.S. Environmental Protection Agency. Heavy downpours have increased in the Southeast, but the region has also experienced periods of extreme drying, according to the agency.

On April 11, Florida Gov. Rick Scott declared a state of emergency because of the wildfires and the high potential for increased wildfires to continue this year as forecasts predict hotter and drier conditions than normal in the state during the coming months.

“That’s really peculiar for Florida, because one of the things wildfires hate is humidity,” said F. Douglas Hoyle, Philadelphia-based loss control director at Pennsylvania Lumbermens Mutual, an insurer of wood and related products. “The humidity has been down significantly in Florida this year, and that’s what experts are saying has led to significant wildfires in Florida.”

Florida wildfires have burned 250% more acreage during the first three months of 2017 than during the same time period last year.

“Three months out, it looks like there might be some hope on the horizon, but the next month in Florida looks to be the worst,” Mr. Clifford said, citing data from the National Oceanic and Atmospheric Administration’s Climate Prediction Center. “Central Florida looks really bad as far as the drought persisting for the next month or so.”

The major modeling firms do not currently have plans to forecast insurance losses related to the Florida wildfires. Wildfires tend to be less costly from an insurance perspective than hurricanes, with the largest estimated insurance loss in the United States caused by wildfire being the $1.7 billion due to the 1991 Oakland Hills Fire, according to Property Claim Services, a Verisk Analytics business.

However, the Fort McMurray fire in the province of Alberta, Canada, became the costliest natural disaster in Canadian history last year, causing a CA$3.6 billion ($2.67 billion) loss, more than twice the cost of the previous largest natural disaster: the 2013 southern Alberta floods, which cost CA$1.7 billion ($1.3 billion) in insurance claims, according to the Insurance Bureau of Canada.

“Wildfire losses are typically dominated by residential properties,” Tammy Viggato, Boston-based scientist at AIR Worldwide, said in an emailed statement. “This is because most wildfires impact the outer regions of an urban area, but don’t penetrate into the center of urban areas where more commercial properties are located, although notable exceptions would be the fires in Fort McMurray and Gatlinburg.”

The 2016 wildfires in Gatlinburg, Tennessee, caused $842 million in insurance losses, according to the Tennessee Department of Commerce and Insurance.

“The Gatlinburg fire burned into the downtown area, and there were a number of businesses that were lost in that fire,” said Steve Quarles, chief scientist for wildfire and durability, Insurance Institute for Business and Home Safety Research Center in Richburg, South Carolina. “That was an eye-opener for the business community.”

In addition to the property losses, business interruption losses can be sizable, as the areas are evacuated and roads are closed, meaning both visitors and employees will likely not be able to access the businesses for some time, which could lead them without enough cash to pay their bills, according to experts.

“People don’t think of all those ripple effects,” said Michele Steinberg, wildfire division manager for the National Fire Protection Association in Quincy, Massachusetts.

Home and business owners can minimize the risks to their properties by creating setback distances between the properties and burnable fuels such as mulch, which is critical because lit embers can come in contact with flammable material and set the property on fire, according to experts.

“To protect businesses, it’s important to do things that minimize the opportunity for these embers landing on or near the building” and resulting in ignition, Mr. Quarles said.

USAA offers a discount on insurance premiums for communities in seven Western states participating in the NFPA’s Firewise Communities program, which recognizes those that take steps to prepare for and mitigate wildfire risks. The insurer covers the risk in standard property policies with no differences in contractual limitations or deductibles compared to other covered perils, he said.

“Wildfire losses tend to be pretty easy to adjust,” Mr. Clifford said.

Source: Business Insurance

Apr 11, 2017 | Blog-All, Informative

As the calendar turns to April, families gear up for spring break car trips or college visits. With better weather, more drivers take day trips or plan weekend getaways. This all adds up to more drivers on the road, and more potential for distracted driving – which also increases the odds of traffic accidents with bodily injuries.

But April is also Distracted Driving Awareness Month, the time of year when the National Safety Council and other organizations join forces to heighten awareness of distracted driving.

According to the National Highway Traffic Safety Administration (NHTSA) distracted driving is defined as any activity that diverts attention from driving, including talking or texting on your phone, eating and drinking, talking to people in your vehicle, or fiddling with the sound, entertainment or navigation system — anything that takes your attention away from the task of safe driving.

NHTSA calls texting “the most alarming distraction” because tests show that sending or reading a text takes your eyes off the road for five seconds. At 55 mph, that’s the equivalent of driving the length of an entire football field with your eyes closed, NHTSA explains.

According to Driver Electronic Device Use in 2015, a Sept. 2016 report from NHTSA, the percentage of passenger vehicle drivers text-messaging or visibly manipulating handheld devices remained constant at 2.2 percent in 2015. Driver handheld cell phone use decreased from 4.3 percent in 2014 to 3.8 percent in 2015, but NHTSA says this was not a statistically significant decrease.

The Property Casualty Insurers Association of America (PCI) is joining nationwide efforts to promote the importance of distracted driving awareness. One of the most frightening trends, PCI says, is the ubiquitous use of smartphones behind the wheel.

“Distracted driving is thought to be one of the leading causes for the rise in vehicle accidents. Whether it’s making a quick call, firing off a text, or adjusting the navigation system, in that short lapse of focus, all too often drivers can cause or fail to avoid a crash. And our increasingly congested roads compound the problem,” said Bob Passmore, PCI’s assistant vice president, personal lines policy.

The implementation and enforcement of distracted-driving laws, which discourage texting while driving and ban handheld cellphone use, are important first steps, PCI says.

“Auto safety is a top issue for auto insurers. We hope the dialogue on distracted and impaired driving will continue, and we urge lawmakers and other industry thought leaders to continue addressing the impact of motorist behavior as an important part of the safety equation,” added Passmore.

Employers and distracted drivers

Not only is distracted driving dangerous for individuals, the Insurance Information Institute ( I.I.I.) points out, but there is a growing concern among business owners and managers that they may be held liable for accidents caused by their employees while driving and conducting work-related conversations on cellphones. I.I.I. explains that under the doctrine of “vicarious responsibility,” employers may be held legally accountable for the negligent acts of employees committed in the course of employment. Employers may also be found negligent if they fail to put in place a policy for the safe use of cellphones.

Here are the top 7 safety tips from PCI and I.I.I. to help you, your employees, your family members and your clients avoid distracted driving.

1. Wear your seat belt.

Whether you’re taking a weekend get-away or just running errands around town, PCI encourages you to buckle up, drive safely and try to be prepared for those who may not. All passengers should be buckled up, even in the back seat.

Seat belts save lives and help prevent injuries. Also, make sure children are in the proper car or booster seats.

2. Plan ahead and allow extra travel time.

With more people on the roads, often driving in unfamiliar territory, the potential for a traffic crash increases. PCI encourages motorists to plan their routes in advance when traveling to new destinations, be patient, and allow for extra travel time.

Some auto accident reconstruction experts suggest that blindly following GPS systems has caused increases in accidents. If you’re going to use an electronic navigation system, check the directions before you start driving to be sure you understand where the system is taking you and where the turns are.

3. Observe speed limits, including lower speeds in work zones.

Stay focused on the road and be aware of changing traffic patterns caused by construction.

Be cautious of the construction workers themselves, who are often in close proximity to the highway—and at great risk.

Many states have increased fines in work zones, yet another reason to be more cautious.

Also, be aware that construction on major highways often takes place at night, when there is less traffic, but reduced visibility.

4. Avoid distracted driving.

When the entire family is traveling in the car, the opportunity for distraction is multiplied.

Remember to put the phone down, and never text while driving.

Be careful when eating on the run, as lunch can be just as distracting as a cell phone. As I.I.I. notes, eating takes both your hand off the wheel and your eyes off the road, so don’t do it. Furthermore, spills can easily cause an accident. If you have to stop short, you could also be severely burned.

Buckle up or secure pets in the back of the car. Never allow your pet to ride in your lap while you’re driving.

5. Have a plan for roadside assistance.

If an accident occurs, be wary of unscrupulous towing companies. Have the phone number for your insurer or a roadside assistance program ready so you know who to call.

Some towing companies take advantage of drivers after an accident, and you could find yourself facing excessive fees or complications recovering your car from the tow yard.

6. Update your proof of insurance.

Before hitting the road, make sure to replace any expired insurance identification cards so you can prove you have insurance in the event of an accident or a traffic stop.

You should also check traffic laws for any states that you’ll be driving through or staying in.

7. Use safe phone habits.

I.I.I. advises drivers to pull off the road to a safe location if you must use the phone or text with someone.

If you must dial from the road, use voice-activated dialing. Program frequently called numbers and your local emergency number into your phone and use voice-activated dialing.

Let your voice mail pick up your calls while you’re driving. It’s easy — and much safer — to retrieve your messages later on.

If you must make or receive a call while driving, keep conversations brief so you can concentrate on your driving. If a long discussion is required or if the topic is stressful or emotional, end the conversation and continue it once you are off the road.

Source: Property Casualty 360

Photo: Shutter Stock